by Sum and Substance Ltd.

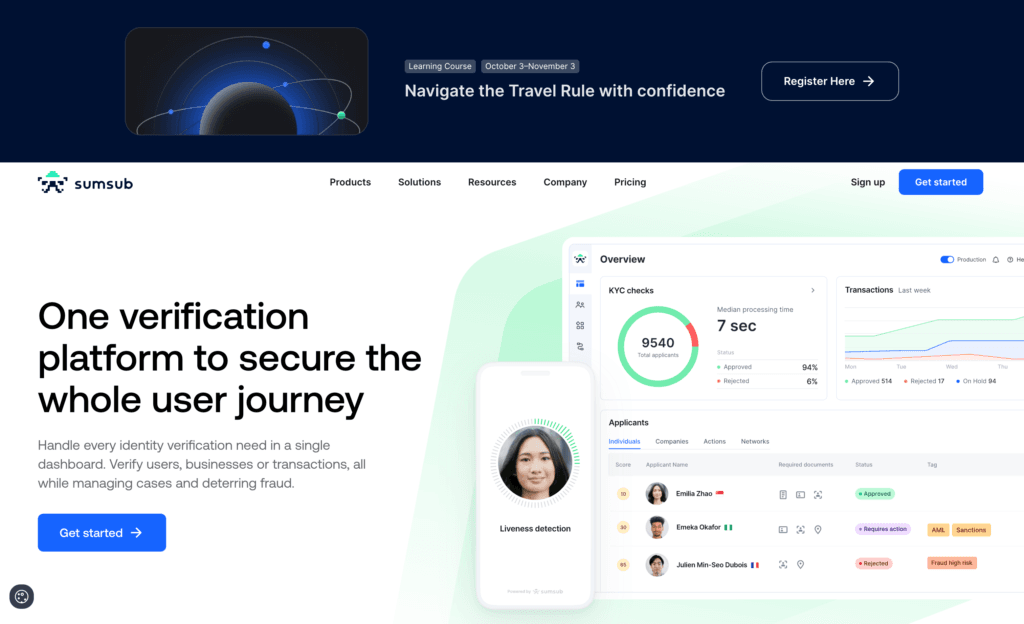

Sumsub’s online user identity verification tool provides a secure and efficient solution for businesses in the UK to verify user identities while ensuring compliance with local regulations. Designed to streamline KYC and AML processes, Sumsub offers a robust platform that enhances the user onboarding experience while protecting against fraud.

Use Cases:

- Financial Services: Ensure compliance with UK KYC and AML regulations for banks, fintech companies, and payment processors.

- Online Gaming: Verify age and identity to comply with UK gambling regulations and prevent underage access.

- eCommerce: Safeguard against fraud by verifying user identities during account creation and transactions.

- Cryptocurrency Exchanges: Meet regulatory requirements for KYC, ensuring a safe and compliant trading environment.

Key Features:

- Automated Identity Verification: AI-powered automation to ensure fast and accurate identity checks.

- Global Document Support: Supports identity documents from over 200 countries, ideal for international businesses.

- Liveness Detection: Advanced liveness detection to prevent fraud by ensuring user presence during verification.

- Customizable Workflows: Tailor verification processes to match your business needs and risk appetite.

- Detailed Analytics and Reporting: Comprehensive tools for monitoring verification outcomes, user trends, and compliance status.

- 24/7 Customer Support: Around-the-clock support to resolve issues and ensure smooth operations.

Supported Obligations:

- Know Your Customer (KYC) regulations

- Anti-Money Laundering (AML) regulations

- UK Gambling Commission Regulations

- UK General Data Protection Regulation (UK GDPR)

- Financial Conduct Authority (FCA) requirements

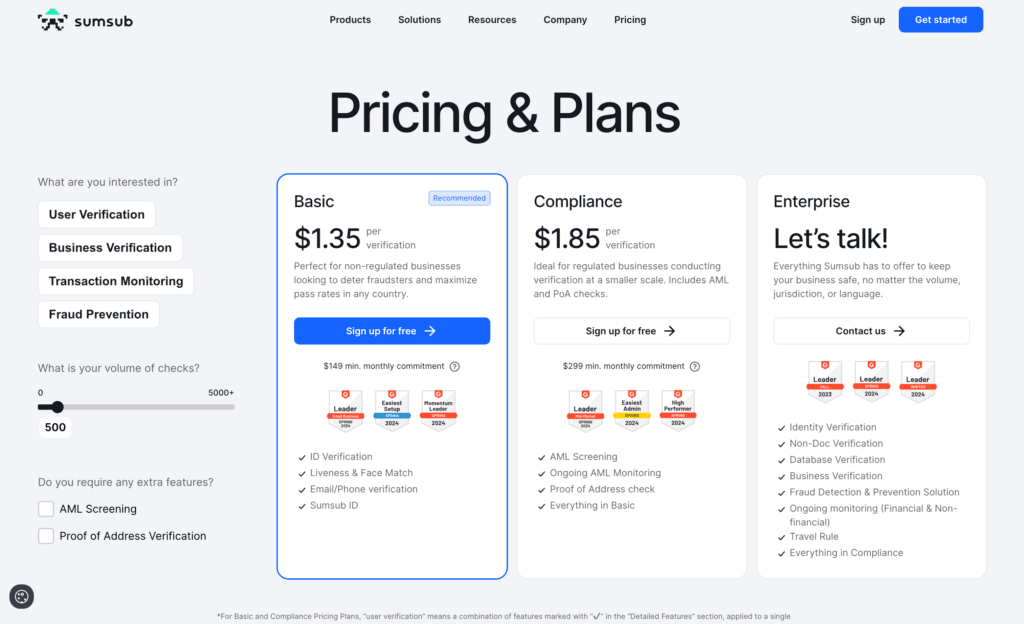

Pricing Options:

- Pay-As-You-Go: Scalable pricing based on the number of verifications performed, suitable for businesses of all sizes.

- Enterprise Solutions: Custom pricing for high-volume verifications, offering advanced features and dedicated support.

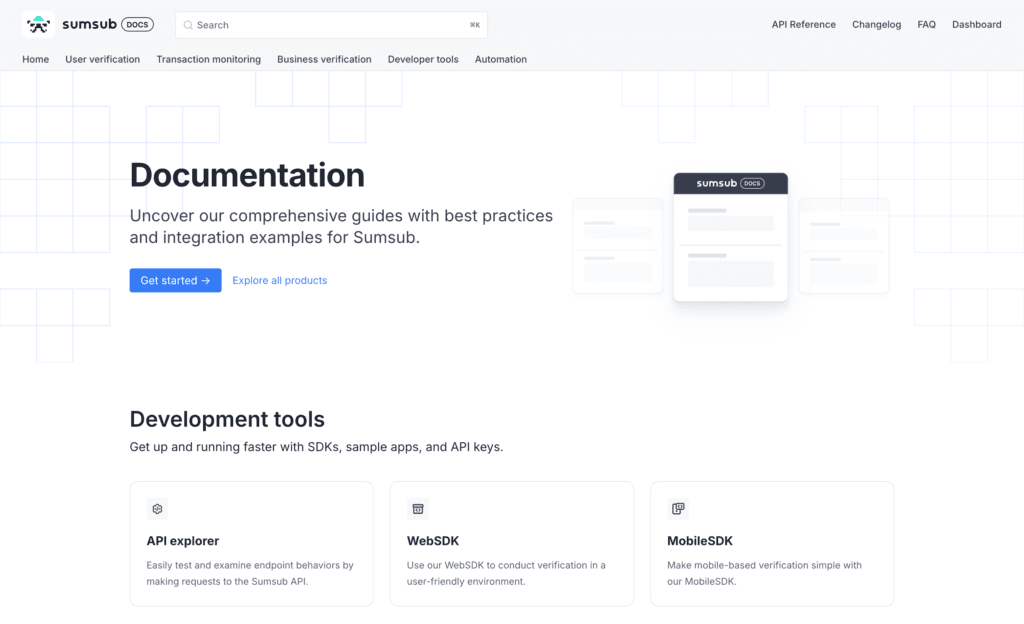

Resources:

- General Product Page: Sumsub Identity Verification Tool

- Pricing Page: Sumsub Pricing

- Documentation: Technical Documentation

- API Documentation: Sumsub API Reference Documentation